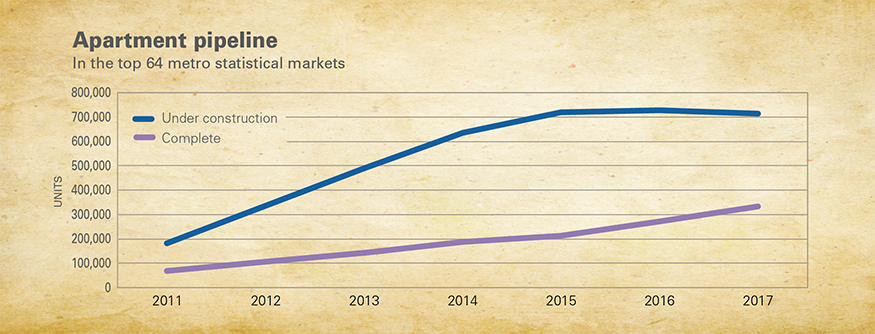

After seven years of rising construction, rents and occupancy, the apartment building boom is finally showing signs of flattening.

The slight dip in multifamily starts in the first half of 2016 might indicate that rampant building in the sector is finally stabilizing. And, while 2017 will see another big bump in deliveries, this year could be the high water mark, as greater capital charges implemented on high-volatility commercial real estate loans have caused lenders to become more conservative about construction financing, said Yardi Matrix VP and General Manager Jeff Adler.

Last year, 303,000 units came online across the nation’s 100 largest metros, up 24 percent from 2015. Another 320,000 units are scheduled for delivery nationwide this year, up 5.3 percent from 2016.

Meanwhile, fundamentals are strong enough to maintain occupancy growth in most metros, while rent growth tapers off from 2015 levels, beginning in metros with previously unsustainable increases and markets where issues of supply, affordability or weakening employment have put pressure on rents, said Adler.

Even so, he expects national rent increases to be above the historical trend of 2.3 percent at slightly less than four percent, a signal that the market is healthy overall.

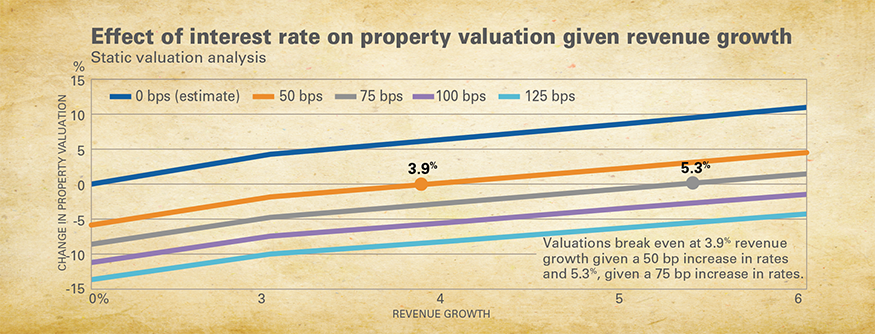

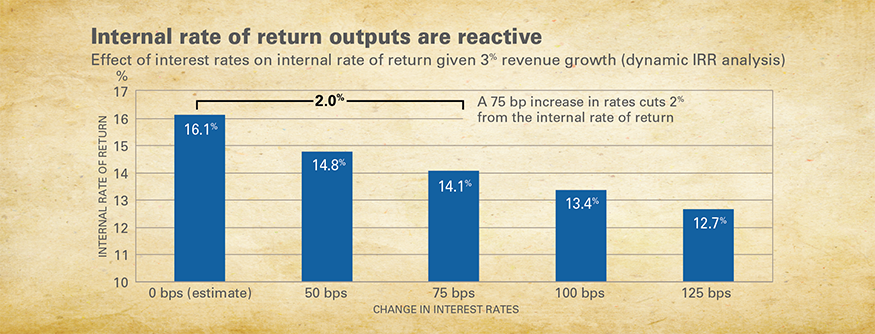

“If we posit that rents grow on average at four percent and NOI at six to seven percent, due to positive operative leverage, then values can absorb a 50-basis-point increase in the 10-year long rates a year and be no worse off, and returns will be a function of cash-on-cash yields. Our model seems to indicate that the rate move clipped one percent off the projected internal rate of return (IRR), on average.

“As I think we’ve seen the bulk of the 10-year move and the move from here will be gradual, I think the overall returns to multifamily will remain mid-teen IRR or higher, based on 65 percent leverage. That’s pretty darn good when you look at the alternatives,” said Adler.

RealPage Chief Economist Greg Willet and MPF Research V.P. Jay Parsons also expect to see some positive rent change this year, with caveats.

“We are probably more optimistic than some folks out there, but we think the rent growth pace will most certainly continue to trail off a little bit,” said Parsons in an early January webcast.

Willits complained about headlines that claim the industry lost pricing power towards the end of 2016, as if indicating a major change in the marketplace.

“We need a reminder that there is seasonality in pricing power. We don’t rent a lot of units in Q4, so rents are positioned pretty conservatively. If we view rents relative to a month or quarter ago, flat to slightly declining rent is in fact normal,” he said.

When he and Parsons compared Q4 pricing power over the past two decades, they found a typical rent dip of 0.2 percent in the final three months of the year.

“Over a 20-year period, the quarterly shift was slightly negative 10 times, very slightly positive eight times and flat twice, and, in the current cycle going back to 2010, there has, on net, been no change. To put context to that, total rent growth in the last 27 quarters has totaled 26.5 percent and zero percent of that has occurred during Q4,” said Willet, recommending that investors and owners make fact-based pricing decisions based on fundamentals rather than letting emotions or the behaviors of their neighbors guide them.

Supply and demand

Demand fell short of supply in Q4, but we finished the biggest quarterly supply of units seen in three decades—84,140 units—a lot for any period, and demand measured in occupancy, came in at 96.1 percent, which is still healthy. Most vacancies were in new projects going through initial lease-up. On the other side, it could be tough to find available product in Class B or C units in a lot of locations, Parsons said.

Supply is growing in downtown markets at a rate two and a half times that of the suburbs, a trend Parsons thinks will continue for at least 18 months. “But low vacancy rates, healthy rent/income ratios and manageable supply in the suburban Class B markets lead us to believe there won’t be a rent slow down in those sectors this year unless the economy loses momentum or jittery operators start pricing overly defensively in the rest of their portfolios,” he said.

Adler thinks that because rent growth in many of highest-rent markets in the country is limited by affordability, the constraint posed on rent growth has become a nationwide issue.

“Metros with above-trend increases in supply as a percentage of stock, such as Dallas, Houston, Seattle, Denver, San Antonio, Orlando, Austin, Charlotte and Washington, D.C., may slow down closer to historical norms until the new units are absorbed, even though these markets have the job engines to attract young workers,” he said.

The Trump effect

While uncertainties exist around November’s surprise election of Donald Trump and the policies of the new administration, the general sentiment in the industry remains optimistic, pundits agree.

They expect to see some tax cuts on the corporate level, deregulation in the financial sectors and more restrictive trade policies, the latter of which Adler says have the potential to negatively affect the apartment industry if the free flow of capital in and out of the U.S. is restricted.

Trump has promised to cut carried interest that allows partners in private investment vehicles a lower rate and the 1031 exchange that allows real estate investors to defer taxes on capital gains, if they purchase another property.

Eliminating the 1031 exchange would impact the market by introducing after-tax returns into the investment equation; the impact probably would be slow erosion in the increase in property valuations and a reduced level of asset turnover among non-institutional investors, said Adler.

But the issue that would have the most direct impact on multifamily is the fate of the government sponsored entities (GSEs) Fannie Mae and Freddie Mac, whose guarantee covers almost all residential mortgages and nearly half of multifamily mortgages.

The new head of the U.S. Treasury Department, former GoldmanSachs executive and chairman of OneWest Bank Steve Mnuchin, has promised to return the GSEs to private hands.

“The GSEs have a huge impact and are critically important and have always been profitable within multifamily,” said Adler. “If we hive off multifamily from single-family, it would be a huge win,” said Adler.

Optimism rules

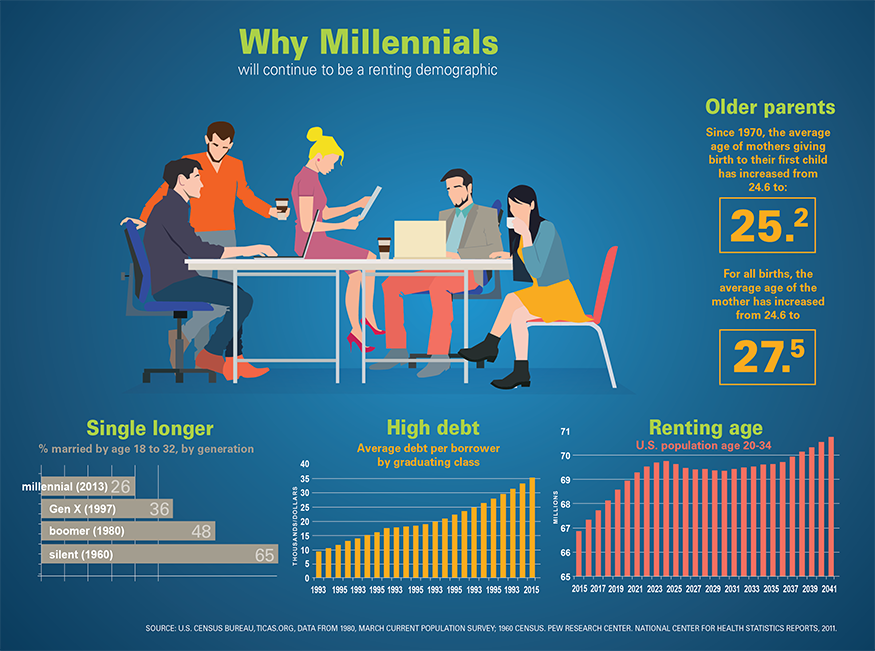

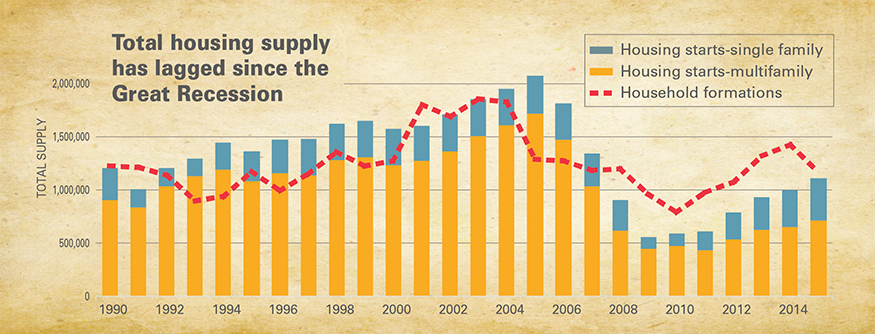

One reason for optimism is that, although new supply has rebounded from recessionary lows, it hasn’t kept up with the surge in multifamily households, which increased by 9.3 million between 2005 and 2015, while owner-owned households dropped by 2.1 million, according to Census Bureau statistics.

Since the sector began to recover from the Great Recession, National Multifamily Housing Council President Doug Bibby has repeatedly told developers they would need to deliver between 300,000 and 400,000 units annually to keep up with demand.

Those numbers were hit last year, yet occupancy of stabilized properties, as of October, were near national all-time highs of 95.8 percent, says Adler.

And, Willet and Parsons believe the big-picture national story is that the market is still a little bit undersupplied, in terms of apartment stock coming on stream.

Most of the pent-up demand is for Class B, Class C or even income-restricted apartments, but the only projects that pencil out are Class A luxury, said Willet.

“We could make the case that the luxury sector is OK in terms of what we are building in that segment, as long as it comes online in the right places. But what we are seeing now is a lot of comparably priced product aimed at the same audience delivering in downtown urban cores within walking distance of each other,” said Parsons.

Adler agrees that current trends in demographics, family size and household formation will support supply at the 300K- to 400K-unit level, “although we will go through a rough patch in 2017. The industry will need to see a more even distribution geographically and at lower price points to make that number easier to absorb. If the 300K to 400K supply continues to be concentrated at upper-end price points and in the same locations, it could erode both occupancy and price levels and squeeze the rent spread between Class A and B assets,” said Adler.

Transactional landscape

With transaction volumes at historic highs, a potential shift in investor appetite could temper that volume this year, warns Integra Realty’s 2017 Commercial Real Estate Trends report.

Willet said developers are reporting that their financing sources are increasingly hesitant to take on any more exposure in the apartment sector.

Adler agrees that investors are beginning to hold back, due to concerns about interest rate increases when acquisition yields are at historical lows.

“Our view is that if rates don’t climb much further, property yields should remain fairly constant because apartment cash flows are stable and the sector remains attractive relative to other investments” he said.

Andrew Warren, director of real estate research at PricewaterhouseCoopers, said in a discussion during an MPF Research webcast in January, that over the past two years the industry has become very aware of where pricing is and how it compares historically and are focused on increasing yields through operations, as opposed to compressing cap rates.

He hasn’t seen a slowdown in lending, even as banks get used to the new risk retention rules associated with Dodd Frank, but adds there could be a rollback on loan generation with the new administration.

“Investors see this as an opportunity to find a position in the middle of the capital stack, between 60 and 80 percent loan-to-value leverage, that would provide opportunity in case banks have to pull back a little,” he said.

“That was one of our ‘best bets’ from our 2017 report,” Warren added, referring to the annual Emerging Trends in Real Estate report, a joint venture of his company and the Urban Land Institute (ULI).

Meanwhile, a recent report from Integra Realty points out that the multifamily sector provides a reminder that no one has repealed the law of cycles.

“The market seeks equilibrium, but its momentum inevitably pushes beyond the point of balance, requiring correction. A few high-end markets have gotten over their skis. However, there are still opportunities to succeed in market niches that have been somewhat neglected—low- and middle-income households whose need for affordable housing seems like afterthoughts during boom times,” says the report.

But Adler believes there is no clear-cut answer to the dilemma of creating Class B and C housing stock, which he says boils down to public policy. “In order for developers to build Class B workforce housing in tertiary or secondary markets where supply is sorely needed, there needs to be a fundamental rethinking at the local level of 1) obstacles to permitting and construction time, and 2) the cost of fees and assessments.

“Longer timelines reduce yields and drive new deliveries to upper price points, exacerbating affordability issues. The causes and solutions are local—paradoxically, the places in most need of lower-priced new supply are the locations with the worst business environments.

“If we truly want added supply of Class B apartments, it will require a lot of heavy lifting and I am not optimistic on that score,” he said.

While the NMHC proposal for Middle Income Housing Tax Credits would help a bit if funded, it will take all of the above, including changes in energy policy, to have a real impact, he said.

Meanwhile, Adler says that value-add investing is a great way to improve existing housing stock to make it viable for Americans with annual incomes of less than $50,000 and is an attractive strategy for private investors.

“We’ve identified a number of “18 hour” metros where this play will be attractive—Atlanta, Dallas, Orlando, Seattle, Portland, Tampa, Austin, Charlotte, Nashville, Salt Lake City, Pittsburgh and Kansas City—all places with vibrant tech hubs. But let’s be clear, it is not a solution for low-income Americans,” he said.

A new normal

The growing number of renter-age households and the 160,000 to 180,000 new jobs expected this year will boost demand for multifamily, said Willet.

And, demand, the biggest driver of supply, is expected to be robust for years, even as long as a decade, says Adler.

The Millennial cohort is projected to increase by two million before it peaks at almost 70 million in 2024, coinciding with a bump in the number of white, college-educated renters relocating to urban areas for the “18-hour” city lifestyle that includes entertainment and access to public transportation. Baby boomers also will impact the market as they downsize.

More good news for the apartment industry is that changes in housing patterns are having a long-term effect on the sector. Homeownership in the U.S. has decreased since the recession and will continue along that trajectory for at least 15 years, according to ULI analysis that projects that by 2030, only 38 percent of Millennials will own homes.

“Homeownership rates may not recover to the levels of 2006 and 2007. People like renting, whether it’s for flexibility or it is a cost or credit issue,” said Warren.

He expects 2017 will be an exciting time for the industry in terms of new technology, adding that the future is bright for innovative developers to bring new product to the market and find new ways to position that product.