An Alabama developer received an $11.227 million loan from Trez Forman Capital to fund redevelopment of a prime piece of property in downtown Birmingham, Alabama. Orchestra Partners is planning a four-story condominium building and 14,170 square feet of retail/restaurant space at 2209-2215 1st Avenue N., where three older and smaller residential buildings currently exists.

The loan, which closed August 6, was arranged by Brett Forman, president/CEO of Trez Forman and Russ Holland, a Trez Forman managing director who oversees the lender’s Atlanta office. Trez Forman has a relationship with the borrower who successfully built and sold out another residential community in downtown Birmingham called Founder’s Station.

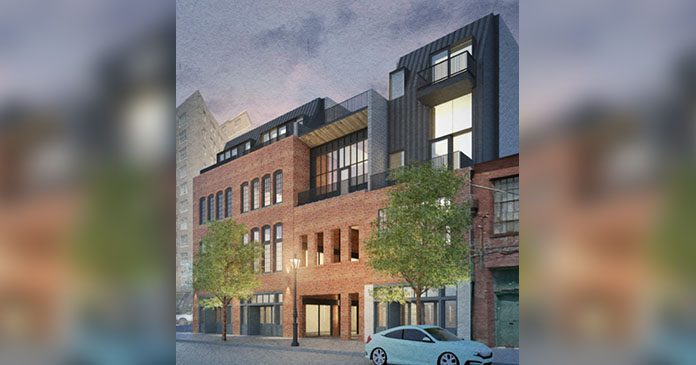

This new adaptive reuse project, named Mercantile on Morris, is located on an iconic downtown street in a highly walkable neighborhood. Orchestra Partners plans on bringing in boutiques, restaurants and bars to the ground-floor retail space.

The community boasts 47 condominium units ranging in size from 289 square feet micro-units to 2-bedroom/2-bath residences of 994 square feet. Nearly half have been pre-sold. Prices range from $99,000 to $329,900 and the developer will arrange financing on purchases up to 100 percent of the cost.

All of the units will feature historic elements and building materials with modern finishes. Residents will have views of either the Morris Avenue, 1st Street or a courtyard and have access to a terrace that overlooks a pedestrian plaza.

“Based on the success our borrower had with their first residential building in the area, we anticipate they will hit another home run with Mercantile on Morris,” said Forman. “It’s a quality project in a popular part of the downtown. It’s priced right for working professionals in the central business district who desire a live, work, play lifestyle.”

Trez Forman provides commercial bridge loans for development and construction and senior stretch financing, starting at $5 million. It also offers private and institutional investors equity investment opportunities in a variety of funds and assets.

About Trez Forman Capital

Founded in 2016, Trez Forman Capital is a Palm Beach, Florida-based commercial bridge lender for development and construction, senior stretch first mortgages and special situations nationwide. It provides developers and property owners with quick approvals on flexible short to mid-term financing from $5M to $75M. Trez Forman has funded nearly $1 billion in loans since inception. The company also offers private and institutional investors equity investment opportunities in a variety of funds and assets. Trez Forman is a joint venture between Palm Beach-based Forman Capital and Trez Capital Group, one of Canada’s largest private commercial mortgage lenders with approximately $3 billion in committed capital. Trez Capital has originated approximately $10 billion in loans since its inception.